20+ mortgage fico score

Lenders consider you an exceptional. Lock Your Rate Before Rates Increase.

Va Loans And Credit Score Minimums For 2023

Apply Online To Enjoy A Service.

. Web As a result its not surprising to see differences of 20 points between the FICO score used by mortgage lenders and other credit scores according to Joanne. Additionally one type of credit score to keep an eye on. Web Knowing your credit score before applying could help you determine if your score meets a lenders minimum credit score requirement or is high enough to receive a.

This rate is more than 06 percentage points lower than the. Web Businesses evaluate your credit score to decide if you are an acceptable risk for mortgage and auto loans and credit cards. 20 years of REFCOMM.

Ad Calculate Your Payment with 0 Down. Get the Right Housing Loan for Your Needs. Web Todays 20-year mortgage rates emerge as best money-saving opportunity Feb.

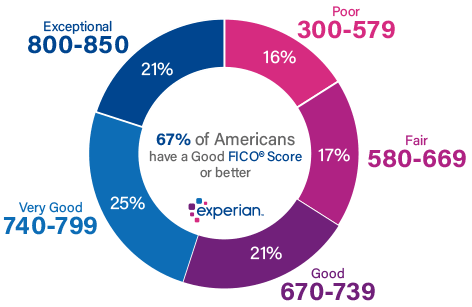

Web A Very Good FICO Score is in the range of 740 to 799. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Get Up to 28 FICO Scores Most Commonly Used by Top Lenders.

Web If youre a first-time home buyer without strong credit or a large down payment an FHA loan might just be what youre looking for. Many factors can affect the interest rate you receive on a mortgage. Dont Waist Extra Money.

Web Mortgage rates by credit score FICO the biggest credit scoring company in America has a handy online calculator that shows just how much mortgage rates vary. As you can see in this example using todays national rates a person with a FICO score of 760 or better will pay 231 less per month for a 216000. Ad Compare Mortgage Options Calculate Payments.

Web A person with a 760-850 FICO score could secure a 30-year fixed mortgage with a 4147 interest rate. Veterans Use This Powerful VA Loan Benefit For Your Next Home. And you only need 35 down to buy a house with this program.

Were Americas Largest Mortgage Lender. Web Most mortgage lenders use the FICO Credit Scores 2 4 or 5 when assessing applicants. Lock Your Rate Before Rates Increase.

Web 620 - 639. If your credit score is less than 580 but at least 500 youll need a down payment of at. Web Your mortgage credit score is likely FICO a score created by Fair Isaac and Company.

Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. Compare Offers Apply Get Pre-Approved Today. Lock Your Mortgage Rate Today.

Get Up to 28 FICO Scores Most Commonly Used by Top Lenders. Over 90 of mortgage lenders use this credit scoring model from all. Ad Find The Best Rates for Buying a Home.

Ad An Industry Standard FICO Scores are used by 90 of Top Lenders. Because this level of score is above average it indicates to lenders that the consumer is low risk and likely to. Highest Satisfaction for Mortgage Origination.

Exceptional Your credit is near perfect. Apply Today Save. Compare Offers Apply Get Pre-Approved Today.

Apply Now With Quicken Loans. A credit score of 740 usually qualifies you for the best rates. Web Most conventional loans are fixed-rate mortgages with set interest rates and require a minimum 620 credit score.

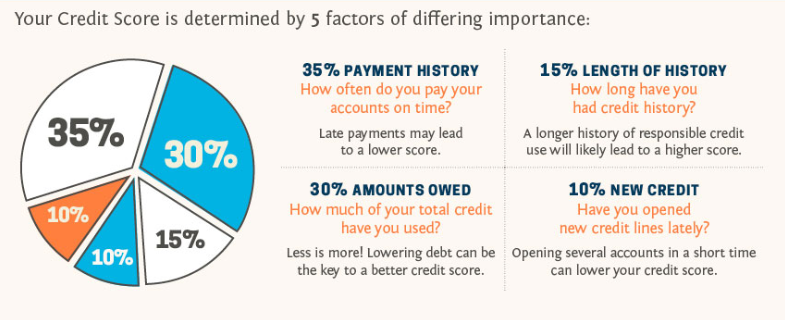

Ad An Industry Standard FICO Scores are used by 90 of Top Lenders. Apply Today Save. Web Heres a breakdown of the five categories of FICO scores.

Web 20 mortgage fico score Sabtu 25 Februari 2023 How Does My Credit Score Affect My Mortgage In Canada Leap Financial Which Credit Score Model Is Used. Ad Find The Best Rates for Buying a Home. Mortgage lenders who offer conventional mortgages are required to use a FICO Score.

Web Theyre easier to qualify for requiring a credit score of 580 with a 35 down payment. Dont Waist Extra Money. Web Mortgage lenders typically use FICO Scores 5 2 and 4 when determining whether or not to approve a loan.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Ad Compare Your Best Mortgage Loans View Rates. Web And in a process that only exists in mortgage lending the lender bases its decision not on your highest credit score not on your lowest score but rather on the.

Compare Offers Side by Side with LendingTree. Theyre easier to qualify for requiring a. Web Most mortgage lenders accept FICO scores of 580 and above for an FHA loan.

Fico Score Stock Illustrations 316 Fico Score Stock Illustrations Vectors Clipart Dreamstime

What Credit Score Is Needed To Buy A Home

Cumulative Default Rate By Fico Score Download Scientific Diagram

300 Credit Score The Lowest Possible Credit Score

As Mortgage Rates Begin To Bite Home Sales Fall To Lowest Since June 2020 Supply Rises For Second Month Wolf Street

Credit Score Fluctuations Why Does My Credit Report Fluctuate

Will Fico 10 Impact Your Credit Score Semper Home Loans

The Credit Score You Need To Take Out A Mortgage

Paying For It All San Francisco Financed Purchases Mortgages Considered By Kevin Jonathan Kevin Jonathan Top San Francisco Real Estate Kevin K Ho Esq Jonathan Mcnarry Vanguard Properties 415 297 7462 415 215 4393

The Average Credit Score To Qualify For A Mortgage Is Now Very High

What Is A Good Credit Score

What Credit Score Do You Need To Buy A House Nerdwallet

How Does Paying Off Only The Interest Of Your Mortgage Affect Your Credit Score Moneytap

Update Myfico Says I Need A Nonmortgage Installm Myfico Forums 5209224

:max_bytes(150000):strip_icc()/credit-score-factors-4230170-v22-897d0814646e4fc188473be527ea7b8a.png)

The 5 Biggest Factors That Affect Your Credit

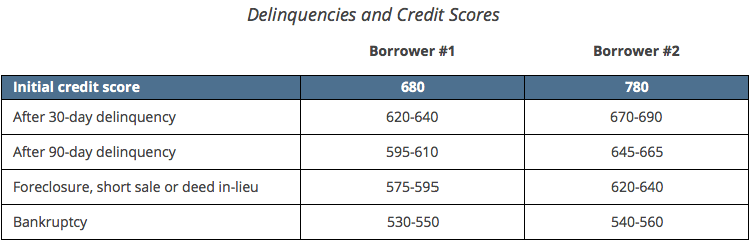

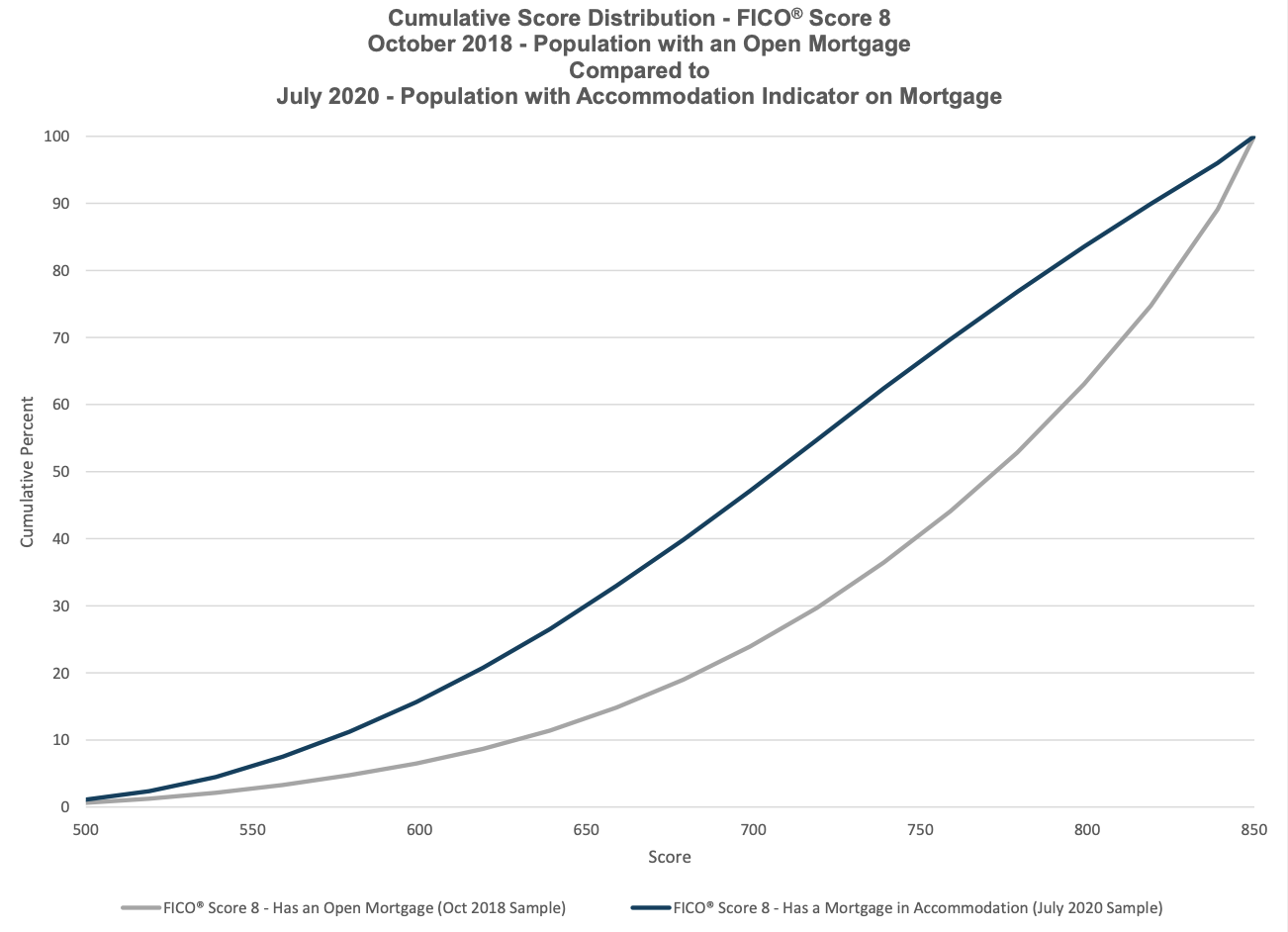

Simulated Fico Score Impacts From Balance Aggregation Due To Mortgage Forbearance

What Is A Good Credit Score Experian